By Ashwini Agarwal

First publised on 2020-07-11 15:10:14

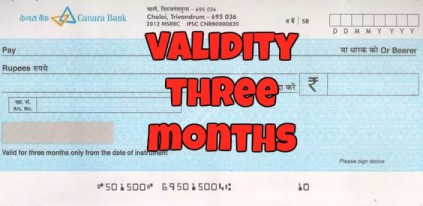

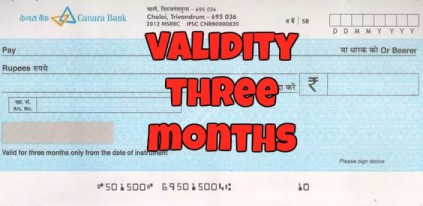

The Supreme Court has done well not to accede to the demand for increasing the validity of cheques beyond three months. It took the plea that since the validity period was not fixed by any statute but was based on an RBI direction under the Banking Regulation Act, it was not proper to pass any order against it. The court also said that the RBI had also pleaded against any changes in the validity. Senior advocate V Giri, appearing for the RBI, informed the court that if the validity of cheques was changed, it would affect the banking system.

The banking system in India functions on core banking where the entire network of banks and almost all the branches have been networked and transactions take place in real-time. Banks in India use any one of the three software packages - Finacle by Infosys, BaNCS by TCS, Flexcube by Oracle - to maintain their accounts. All of them have been integrated with the core system. Each banking transaction gets a unique identification number once it is entered into the system by any branch. All these software packages and the main core banking system would need to be reoriented if the validity of cheques is extended beyond 90 days. It would throw the banking system out of gear for several days.

The pandemic has caused severe disruption in many sectors of the economy. But banking is one sector that has been running throughout the lockdown period, providing yeoman's service to all citizens. If processes are tinkered with due to small issues it will be disastrous. It will also set a bad precedent. Some other solution needs to be found for the problem being faced by the limit on the validity of cheques. The RBI must address this issue by giving suitable directions.